Goodbye, sunshine

Oh, the more I wait, the less the time is mine

As new fades to old

Watch the truth reveal the less I want to know

“Goodbye, Sunshine”, Coheed and Cambria

Coheed and Cambria’s recently released 11th studio album, The Father of Make Believe, explores themes that feel particularly well suited to this market environment (as always, we recommend turning the speakers up to 11 to enjoy this catchy, melodic metal as background music to today’s Edge, if you are so inclined).

The album touches on themes of confronting loss, the lessons of self-reflection, and the “quest to find meaning in a disorderly world”. That last theme strikes home as equity markets lurch lower and volatility jumps higher.

Our favorite track from the album, “Goodbye, Sunshine”, is a perfect soundtrack to the fading of radiant Great Expectations that proliferated markets to start the year. Our central thesis for 2025 was that these Great Expectations for further strong equity market returns, robust U.S. economic growth, and highly supportive DC policy would be challenged by the limiting realities of already-stretched valuations, crowded positioning, growth forecasts that did not contemplate downside, and the likelihood of DC policy being a source of disruption.

The Street has started coming around to our view of more challenged equity market returns and lower GDP growth for the year, singing “Goodbye, Sunshine” to bright S&P 500 targets and cutting estimates for the full year. The median YE 2025 forecast for the S&P 500 has been trimmed from 6,600 in mid-February to 6,430 today (Bloomberg).

Eventually these forecast cuts will be a great set up for future returns, as the expectations bar is lowered, but given this new price target still implies an achievement of new all-time highs before the end of the year, we think there are likely still more cuts to come (our view for 2025 is a wide choppy range for equities, where we are “On the Road to Nowhere” over the course of the year, with downside weakness buyable).

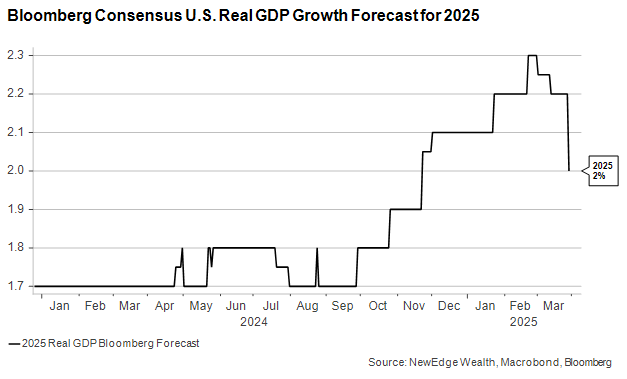

Analysts are also singing “Goodbye, Sunshine” to glowing GDP growth forecasts, with forecasts for 2025 growth getting slashed over the last week to 2% from 2.3%. Recall our “most important chart of the past two years” was GDP forecasts for 2023 and 2024, making a steady march higher, which we saw as the key underlying driver of strong risk asset returns. As this trend towards stronger growth estimates turns negative, risk assets find themselves “holding the wrong end of the knife”, with a much tougher backdrop for returns while estimates are getting cut.

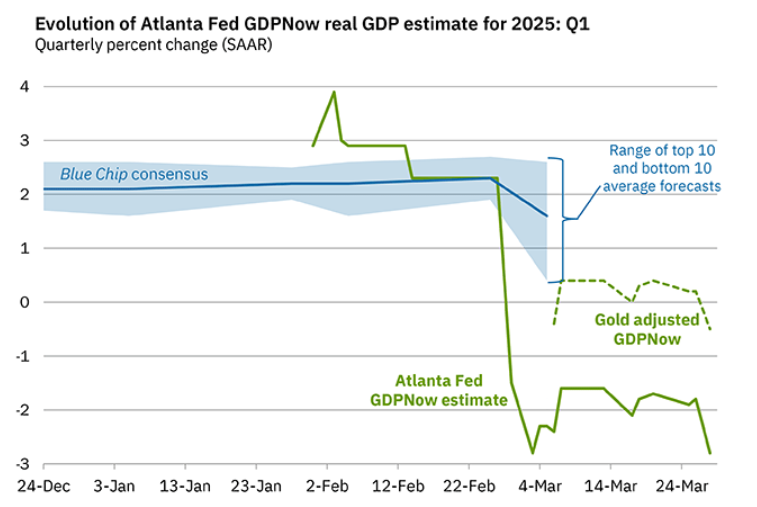

These stormier estimates for 2025 GDP growth reflect the stumble-start to 2025 growth, as captured in the current Atlanta Fed GDPNow forecast that is tracking negative for 1Q25.

The last big area we are seeing analysts sing “Goodbye, Sunshine” is in earnings forecasts, which are getting trimmed across all sectors in the S&P 500, except for, peculiarly, financials.

S&P 500 2025 Consensus EPS Forecast and Price

Financials Sector 2025 Consensus EPS Forecast and Price

We highlight the lack of cuts for financials because they are the first major sector to report earnings and often set the tone for earnings season, which begins on April 11.

It must be noted that many of the drivers of strong earnings growth expectations for the financials have not materialized in 2025. Analysts rapidly raised forecasts post-election on the hopes for a much steeper yield curve, a boom in M&A and IPO activity, and deregulation. To start 2025, the yield curve is basically flat, M&A and IPO activity has been sluggish at best due to high uncertainty, and little progress has been made on deregulation.

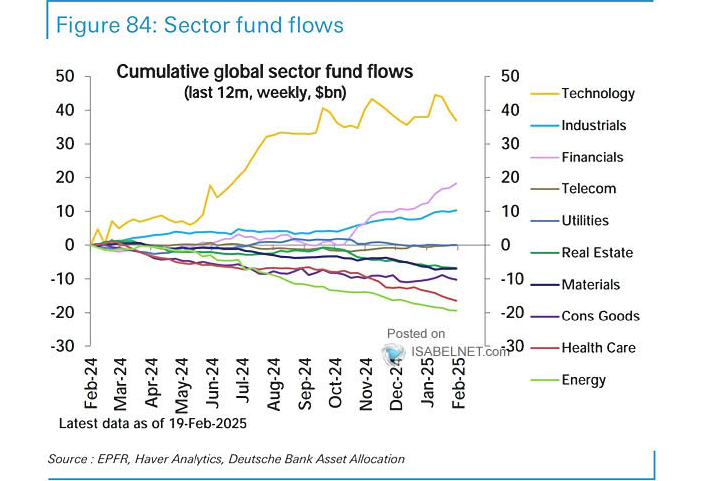

It will be fascinating to see how financials navigate this earnings season, which begins with the big banks in just two short weeks. The financials sector has exhibited strong relative performance versus the market, as shown in the first chart below, and has been the beneficiary of flows out of Tech, as shown in the second chart below. The challenge is that this strength sets a higher bar to surprise to the upside, with the risk of an unwind of Financials’ “momentum stock” status.

Financials Sector Absolute (Top) and Relative to the S&P 500 (Bottom)

The potential for volatility to continue through earnings season is one reason why we have not been calling for a sharp V-shaped recovery in equity markets in the near term. We see bounces as likely once oversold conditions are met (we would note that as of Friday the S&P 500 was not oversold on external measures like the RSI or internal measures like the % of names above their 50 day moving averages), but as we have been flagging, and has materialized in the last few trading days, there is risk that markets could roll over as they hit resistance levels.

This does not mean that equity market weakness is not buyable, with history showing that forward returns improve significantly post 10%+ corrections, but we think that investors need to have patience and an acceptance that volatility is likely to persist. As we wrote two weeks ago, investors should “get comfortable being uncomfortable.”

Claudio Sanchez of Coheed croons in “Goodbye, Sunshine”, “I believe the darkness will find the light”, which we think is an important sentiment for investors looking to take advantage of volatility, knowing that eventually the “darkness will find the light”, even if it takes some patience and volatility perseverance.

IMPORTANT DISCLOSURES

[dipl_divi_shortcode id=”40772″]