“Did you get that memo?”

Fed rate cuts appear to be on hold. Global government bond markets are in retreat. And stocks have been jittery in the opening days of 2025. The trend for each of these hinges, to varying extents, on whether the U.S. job creating machine can continue humming in 2025. The December U.S. employment report gave us hope that it can.

We can think of no better film than 1999’s Office Space, the seminal modern film about American work culture, to serve as the running theme for this labor market-focused Weekly Edge. After recapping the December employment data, we’ll cover the broader U.S. labor market and the implications for interest rates, economy policy, and investors.

“A straight shooter with upper management written all over him.”

Pessimistic investors coming into 2025 fell largely into two camps. The first group is afraid that growth will slow rapidly and take down lofty equity markets. The second sees a hot economy pushing interest rates and consumer prices higher and crushing profit margins. Neither of these risks is evidenced in the December U.S. employment data.

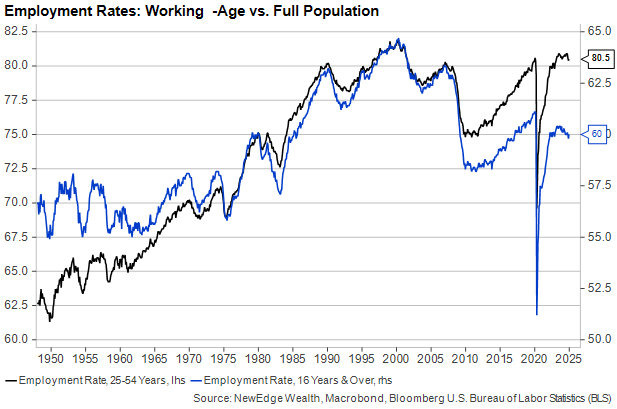

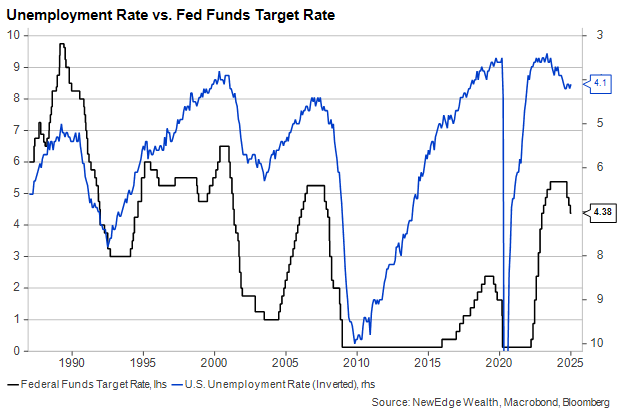

The report showed unexpectedly strong private sector job creation (+223K vs. +140K expected) and a welcome drop in unemployment to 4.1%. The prime-age employment ticked up to 80.5% after falling for a few months, and average hourly earnings growth – the closest thing to a wage indicator in the report – eased back below 4% in a sign the labor market has cooled but not frozen over.

“If they move my desk one more time…”

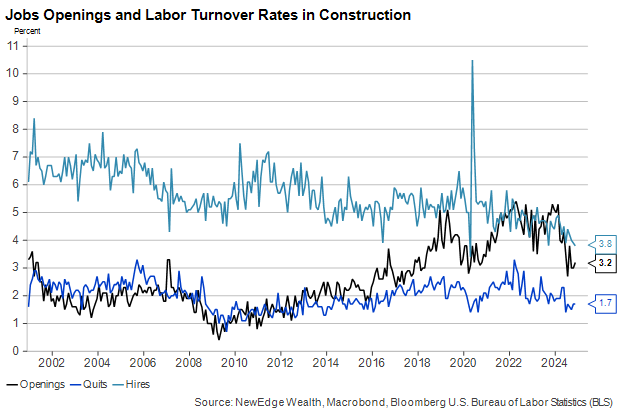

One reason the December report came as an upside surprise to markets is that earlier this week, the November Job Openings and Labor Turnover Survey (JOLTS) showed weaker private-sector hiring and a further fall in voluntary resignations. After an unprecedented wave of “quits” in 2021 and 2022, workers are now sticking to their jobs at the highest rates in ten years.

As the graph shows, when fewer workers leave their posts for greener pastures, wage growth has decelerated over the next year. Employers typically have to offer higher wages for job switchers, meaning static labor markets typically do not see salaries rising quickly. This is consistent with the moderation in average hourly earnings growth we saw in the December employment report, but the weak hiring rate in the JOLTS report does not match the strong payroll growth over the last two months. As always, more data is needed.

“It’s not that I’m lazy…”

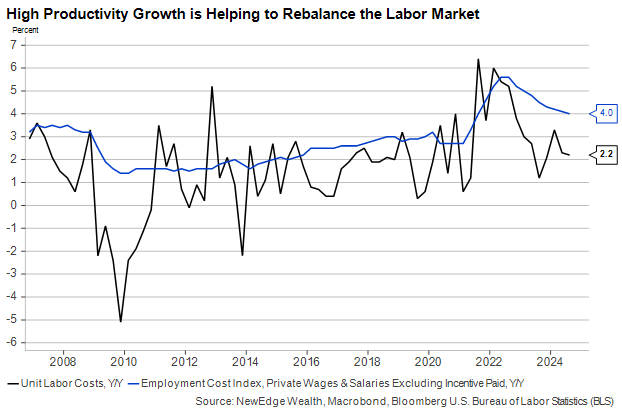

In last week’s Weekly Edge, we noted that high productivity growth in the late 1990s allowed the U.S. economy to run faster for longer with high interest rates than it may have been able to otherwise. Booming (and cheap) Chinese exports at the turn of the millennium were another contributor. Today, similarly strong and durable productivity growth has allowed firms to retain headcount and increase wages without the cost of tighter profit margins, even with higher interest rates for longer than many expected.

This graph shows Unit Labor Cost (ULC) growth, which measures how much firms need to pay to produce one unit of output. ULC growth hinges not only on wages and units of output but also on the time it takes to produce them. While employment cost growth (i.e., wages) remains elevated, ULC inflation has returned to its pre-COVID range. This has helped the labor market withstand pressure from high and rising interest rates over the past few years.

When ULC growth slows because productivity is rising, firms generally do not need to cut wage costs to preserve profit margins. High productivity growth has helped keep operating margins wide and, if sustained, would go a long way to keeping growth and employment strong in 2025.

“I have people skills! I am good at dealing with people!”

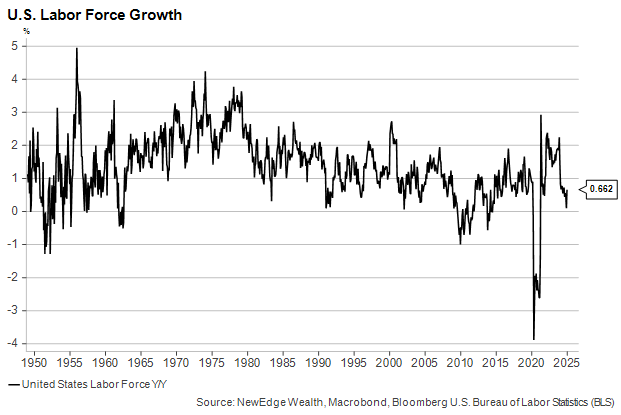

The other key factor helping the economy return to balance over the past two years has been high working-age population growth. This is primarily a result of the sharp increase in immigration following the pandemic. A spike in workers came at precisely the time when demand for them was putting upward pressure on wages and, ultimately, prices.

As the wave of immigration has subsided, working-age population growth has slowed to closer to its 2010s average, which was already slower than the decades preceding it. The December report showed a welcome increase in the labor force, but it’s just one month. Demography is destiny for any economy, and the sustainable rate of GDP growth will ultimately be hostage to how quickly the workforce continues to grow.

One sector of the economy that continues to concern us is real estate. Good data is better than bad data, but it also tends to push interest rates higher and impairs the industries that have been counting on easier financial conditions to operate. Housing is one such area. Manufacturing is another. The November JOLTS data showed fewer openings for construction jobs and fewer employers hiring.

While a massive fall – or reversal – in immigration could forestall construction layoffs in 2025 (since the industry relies so heavily on immigrant workers), the path of interest rates will ultimately determine whether activity picks up. Mortgage demand is weak, and builders are reluctant to take on new projects with financing costs so high.

Residential investment did not add much to overall growth in 2024 despite a promising start to the year, and rising rates were a big reason why. It could very well detract from growth in 2025 if fewer homes are built and sold. And the downstream effects that will have on consumption threaten to weaken growth further in the future.

“We always like to avoid confrontation whenever possible.”

Hawks on the Fed’s Open Market Committee will feel vindicated by the strong labor market data, and markets have priced out any further rate cuts from the Fed until the second half of this year. Even if inflation continues its slow descent, the Fed is only likely to cut rates further if the unemployment rate increases. The bar for cuts is not especially high, as the latest Fed forecast shows the jobless rate ending the year at 4.2%, only 0.1% higher than it is today. But we suspect unemployment will need to reach closer to 4.5% by summer to bring the Fed back off the sidelines.

The “Jump to Conclusions” Mat

December’s job data delivered a significant positive surprise to consensus forecasts, which is rippling through markets as we write this. Interest rates are notably higher, and the stocks of companies that were hoping for the opposite, such as small caps, are suffering.

At the same time, cyclical companies with less debt and higher profitability scores are outperforming. We continue to view this segment as the sweet spot for equity markets compared to the more expensive, high-growth names that have dominated over the past two years.

Still, the year is still young, and the next slew of data points may disappoint us, causing yields to fall back and stocks to rotate once more. But we think the keys to the labor market in 2025 will be: 1) whether profit margins remain wide enough to ward off layoffs; and 2) whether asset prices will remain high enough to keep consumers confidently spending.

IMPORTANT DISCLOSURES

[dipl_divi_shortcode id=”40772″]