Ooooo, and it’s alright and it’s comin’ on

We gotta get right back to where we started from

“Right Back Where We Started From”, Maxine Nightingale

Maxine Nightingale’s 1975 banger “Right Back Where We Started From” is, for hockey fans, an anthem of redemption, success, and celebration.

Made famous in the U.S. by the 1977 sports comedy Slap Shot (staring Mr. Paul Newman himself, *does nose tap from The Sting*), Nightingale’s soul classic is still used by some hockey teams to celebrate victories at the end of games.

Now, as any hockey fan knows, victories on the ice are often hard fought, leaving players bruised and broken (much like any game scene in Slap Shot). But a win is a win.

As we look at GDP and EPS estimates through 2025, we are reminded of this Nightingale notion of returning to where you started, potentially a little bruised from the journey, but still celebrating the overall “win”.

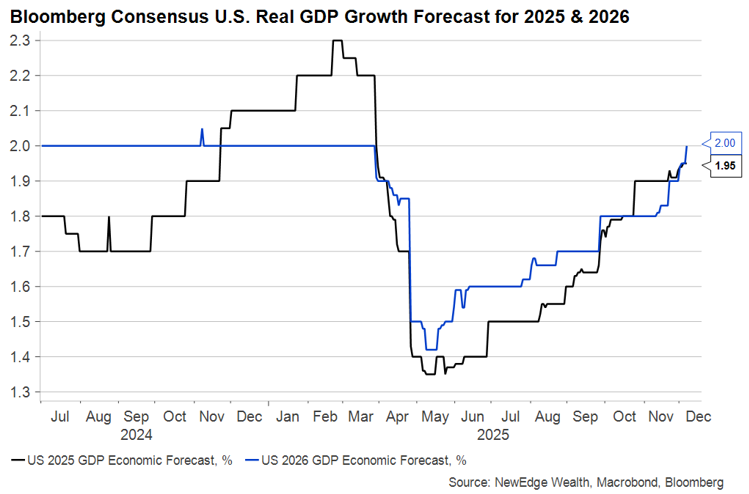

The chart below shows the path of 2025 and 2026 GDP growth estimates over the course of this year. You can see the bruising impact of Liberation Day/tariffs on growth expectations, where forecasters assumed the significant increase in trade taxes would push growth to well below trend (assumed ~2-2.5%), or seen differently, as forecasters increased their expected probability of recession. Since May, these forecasters have been raising their GDP estimates, bringing 2026 estimates “Right Back Where We Started From” to 2%.

Of course, a return to trend (or slightly below trend) growth in 2026 is not all too industrious of a forecast, mostly in the context of next year’s large fiscal stimulus/deficits, expectations of further monetary stimulus/easing, and assumptions for continued large technology infrastructure investment. It must be noted, though, that these potential growth drivers could be countered by tariff impacts, immigration policy weighing on labor force growth, and a clear slowing in job additions in recent months (which could be related to immigration, growth uncertainty, and even technology adoption).

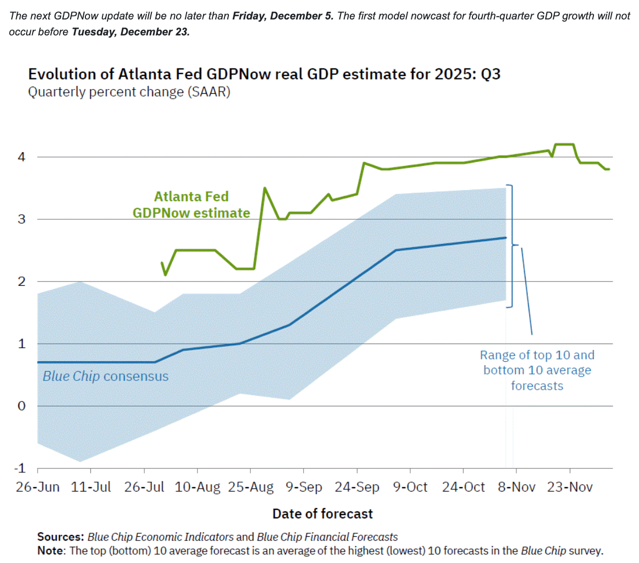

The 2% GDP growth forecast likely reflects uncertainty as much as it does confidence, as key swaths of data from the last few months are still missing thanks to the government shutdown. We can see this with Atlanta Fed GDPNow forecasts, which are still on 3Q25 estimates (at a whopping 3.8%!) and won’t switch to forecasting 4Q25 until December 23, effectively taking the “now” out of “nowcast”. Thus, a 2% target may just be a proverbial placeholder.

Though we continue to wade blurrily through the economic data front, we are getting updated results and forecasts from US publicly traded companies, which also paint a “Right Back Where We Started From” picture.

The chart below shows S&P 500 earnings per share (EPS) forecasts for 2025 and 2026. Here you can see a similar pattern of these forecasts getting slashed in the wake of being Liberated, and proceeding to climb higher since May. The 2026 EPS forecast for $308/share is now above its prior high at the start of this year.

S&P 500 EPS Estimates for 2025 and 2026 (Bloomberg Consensus)

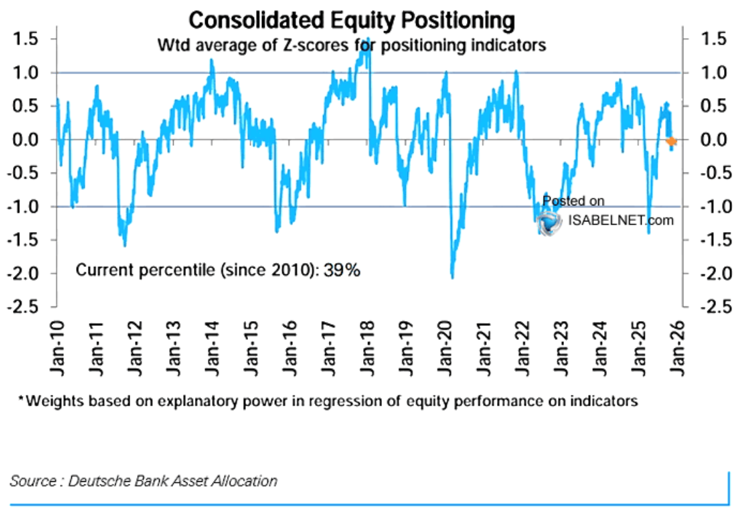

This observation about climbing EPS estimates has been a key reason why we saw potential for continued further upside in equity market prices, driven as well by light institutional positioning that still had (and has) room to chase markets higher. See the Deutsche Bank Consolidated Positioning in the below-neutral 39th percentile below.

Back to earnings, it must be flagged that this return-to-highs for EPS forecasts is not a happy fate shared by all companies. In fact, looking at Equal Weight S&P 500 earnings forecasts reveals that these estimates are still getting cut for 2026.

Equal Weight S&P 500 EPS Estimates for 2025 and 2026 (Bloomberg Consensus)

We can contrast this to the path of earnings growth forecasts for the Bloomberg Magnificent 7 Index, which continue to trend ever higher. This juxtaposition of Equal Weight and Mag 7 earnings revisions is a great reminder as to why this large cap equity market has been so narrow in its leadership: narrow earnings growth drives narrow price performance.

Magnificent 7 EPS Estimates for 2025 and 2026 (Bloomberg Consensus)

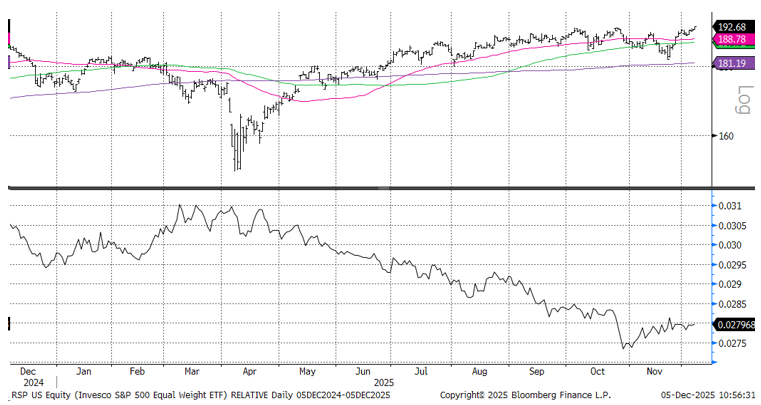

The continued earnings decline in the Equal Weight index is not stopping the annual rallying cry for a “broadening out” of market leadership away from Mag 7, and it appears that some investors are putting their money where their mouth is, with the Equal Weight S&P 500 eking out a new high this week and seeing a slight improvement in its relative performance, as shown below.

Equal Weight S&P 500 Absolute (top) and Relative to S&P 500 (bottom)

Some broader context is helpful here, with an explicit bet against the largest weights of the index by choosing the Equal Weight index being a distinctly “losing game” over the last three years.

Equal Weight S&P 500 Absolute (top) and Relative to S&P 500 (bottom)

One argument that we have been making consistently over the last few years is that risk assets (equity and credit) “like” rising growth forecasts for GDP and EPS, suggesting that as long as growth forecasts were rising, risk assets had the potential levitate at high valuations and generate positive returns.

This means that, as we near the turn of the year, it is vitally important to assess if 2026 estimates for GDP and EPS have room to be revised lower or higher.

For earnings, the $308 implies an acceleration in revenue growth to 6.7% (from 5.6% in 2025) and a whopping 200 bps of operating margin expansion to a record 23.2%. Notably, forecasters are expecting growth from the Mag 7 cohort to slow in 2026 (revenue growth to slow to 14.8% from 22% in 2025), while they expect Equal Weight growth to accelerate (revenue growth to 5% from 1.5% in 2025). We think these estimates already capture a host of optimism about a broadening out of earnings, a veritable boom in productivity, and likely a continued hoovering up of shares through company stock buy backs.

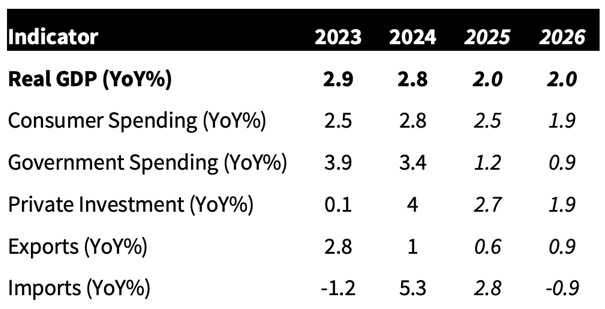

For GDP growth, the table below shows the Bloomberg consensus forecasts for growth.

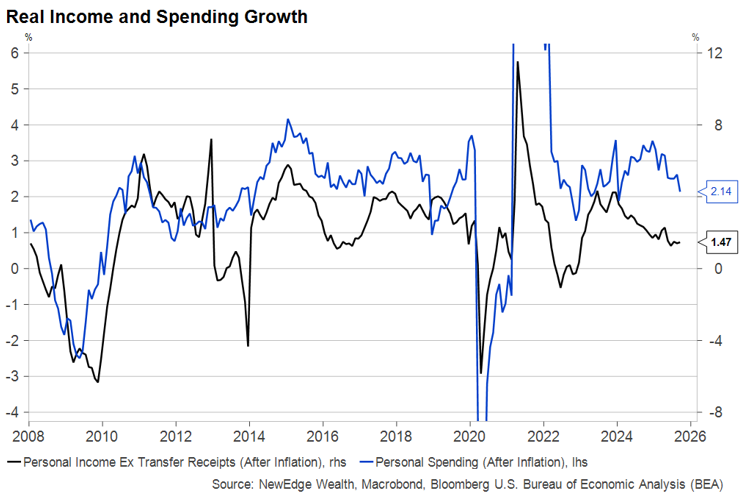

A key point is that consensus is expecting a deceleration in household consumption, which is not surprising given the observation that our Brian Nick made about lackluster personal consumption data on Friday: “Real spending can’t escape the gravitational pull of falling real incomes forever”.

Conclusion

We were tempted to take a highbrow approach and use T.S. Elliott’s line from Little Gidding to evoke the idea of returning to where we began:

We shall not cease from exploration

And the end of all our exploring

Will be to arrive where we started

And know the place for the first time.

But alas, there has been nothing highbrow about 2025, so Slap Shot it is!

Now that we are back to prior highs for 2026 GDP growth and S&P 500 EPS estimates, the ultimate question is “where do we go from here?”.

We will dissect this question and many more in our 2026 Outlook, which we always publish the 2nd week of January (we read The Price is Right strategies!), so be sure to keep an eye out for the webinar invite. In the meantime, enjoy the continuation of the holiday season (and may they be brawl-less, unlike those Charlestown Chiefs).

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC

The post Right Back Where We Started From appeared first on NewEdge Wealth.