Latest Investments & Planning Insights

Weekly Edge

At the end of the trading week, the team at NewEdge Wealth publishes its commentary on the week that was, as well as some insights into what it means for clients looking ahead.

The Masterplan

All we know is that we don’t know Oasis, “The Masterplan” Of the things from 2025 that we would like to see more of in 2026, at the top of the list is Oasis reunion concerts (maybe with even more B-side cuts, like those included on the band’s The Masterplan 1998...

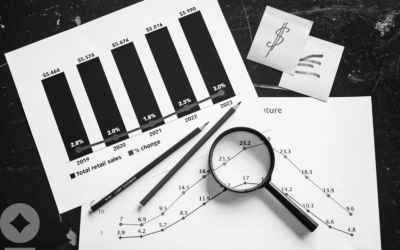

The Muppet Charts Carol

Though the initial critical reception of 1992’s The Muppet Christmas Carol was mixed (a thumbs down on Siskel & Ebert!), modern wisdom and taste have caught up to the precious pointedness of the pint-sized production, with the movie now being lauded as “the...

Knives Out at the Fed

The Case of the Dovish Central Bank It’s a strange case from the start. A case with a hole in the center. A doughnut. This week, the Federal Reserve’s Open Market Committee (FOMC) held its final monetary policy gathering of the year, and it used the occasion to slash...

Right Back Where We Started From

Ooooo, and it’s alright and it’s comin’ on We gotta get right back to where we started from “Right Back Where We Started From”, Maxine Nightingale Maxine Nightingale’s 1975 banger “Right Back Where We Started From” is, for hockey fans, an anthem of redemption,...

Wealth Strategy

A successful wealth strategy process benefits from a team of advisors, collectively focused on the goals specific to your family. Below are some of the insights and strategies the team at NewEdge has published on what it means to have a wealth strategy, rather than a simple financial plan.

Articles, Webinars & Media Appearances

#Millennials: The Startup Generation

Born between 1981 and 1996, Millennials are the largest generation in the U.S. workforce today, numbering over 72 million. As the first true digital natives, they grew up alongside the internet, mobile technology, and social media.

Master Your Business Exit: A Roadmap to Valuation and a Financially Secure Future

But now, as you begin to think about selling your business or transitioning into retirement, it’s time to pivot your focus. The question isn’t whether you’ll exit your business, but how you’ll do so in a way that aligns with your financial goals, maximizes your wealth, and protects your legacy.

Building Your Own Path: Next Generation Wealth Planning

Discover how the next generation can build independent wealth, align financial goals with values, and create a lasting family legacy.

The Investor’s Edge: Key Trends Driving Today’s Markets

The last few weeks of AI-infrastructure deal announcements have raised many an eyebrow about the circular nature of these deals (ex. Nvidia investing in $100B in OpenAI so that OpenAI can buy NVDA chips, alongside a $300B OpeanAI deal with Oracle that will purchase even more NVDA chips), and stirred up memories of the ill-fated vendor financing boom of the 1990’s tech bubble.

CNBC Appearance: The equity market is not signaling concern about meaningful growth, notes Cameron Dawson, CFA®

Cameron Dawson, CFA®, Chief Investment Officer, joins CNBC’s ‘Closing Bell’ to discuss market outlooks.

Bloomberg Appearance: Cameron Dawson, CFA® on Stagflation, Margins, and Market Resilience

Cameron Dawson, CFA®, Chief Investment Officer, discusses how stagflation, Fed policy, and weakening labor trends may impact earnings and equity markets.

Bloomberg Appearance: Investor Caution Persists Amid High Valuations, highlights Brian Nick of NewEdge Wealth

Brian Nick, Managing Director, Head of Portfolio Strategy, notes that despite strong equity performance and elevated valuations, investor caution remains high due to concerns about long-term interest rates, Fed independence, and geopolitical risks.

Bloomberg Appearance: Brian Nick of NewEdge Wealth on Growing Investor Caution

Brian Nick, Managing Director, Head of Portfolio Strategy, discusses how markets are treading carefully as investors await comments from Fed Chair Jerome Powell.

Fox Business Appearance: “The trend in the market is still resoundingly positive,” says Cameron Dawson, CFA®

Cameron Dawson, CFA®, Chief Investment Officer, analyzes why the market is continuing to climb on ‘Barron’s Roundtable.’